US inflation rose in October, driven by higher costs of rentals, used cars and airline prices, in a sign that price increases may be stabilizing after slowing in September to their lowest pace since 2021.

The Labor Department said Wednesday that consumer prices rose 2.6% from a year earlier, compared to 2.4% in September. This was the first rise in annual inflation in seven months. From September to October, prices rose by 0.2%, the same as the previous month. Excluding volatile food and energy costs, “core” prices rose 3.3% from a year ago, the same level as in September. From September to October, core prices rose 0.3% for the third month in a row. In the long run, core inflation at this pace will exceed the Fed’s 2% target.

Rising prices, if they persist, would raise concerns in financial markets that progress in taming inflation may slow. It could also make the Fed less inclined to cut its key interest rate in the coming months, as its officials have previously indicated they are likely to do.

Story continues below ad

However, most economists believe that inflation will eventually resume its slowdown. Since then, consumer inflation, which peaked at 9.1% in 2022, has declined steadily, although overall prices are still about 20% higher than they were three years ago.

The rise in prices made Americans nervous about the economy and the economic management of the Biden-Harris administration and contributed to the loss of Vice President Kamala Harris in the presidential elections last week.

The impact of the Trump presidency on the Canadian economy

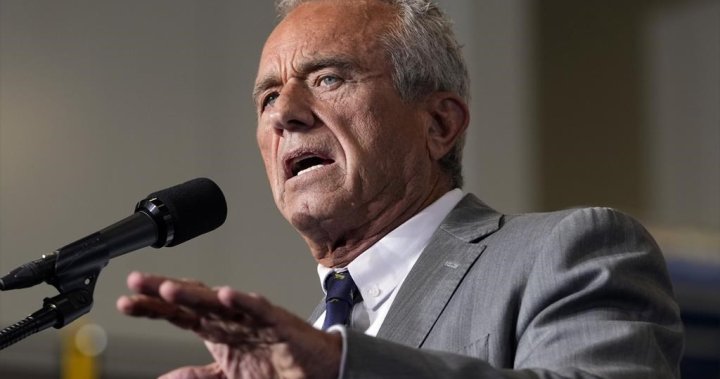

However, Donald Trump’s victory raised a great deal of uncertainty about where inflation might head and how the Fed would react if it accelerated again. Trump pledged to reduce inflation by increasing oil and gas exploration. But key economists have warned that some of his proposals, especially his plan to dramatically increase import tariffs and continue mass deportations of immigrants, would worsen inflation if fully implemented.

Get weekly money news

Get expert insights and Q&As on markets, housing, inflation and personal finance information delivered to you every Saturday.

Stock prices rose in the wake of Trump’s election victory, mostly due to optimism that proposed tax cuts and deregulation would boost the economy and corporate profits. But bond yields also jumped, likely reflecting fears of accelerating inflation.

Trending now

-

![]()

Former British Columbia Premier John Horgan has died after a battle with cancer

-

![]()

Kate Middleton’s fans have criticized the TV star for making a “mean” comment about the princess’s appearance

Story continues below ad

In addition, the economy is growing faster than many economists expected earlier this year. It has expanded at an annual rate of nearly 3% over the past six months, with consumers, especially those with higher incomes, spending freely and fueling growth.

At a news conference last week, Federal Reserve Chairman Jerome Powell expressed confidence that inflation was still heading toward the central bank’s 2% target, although it may be slow and uneven.

Powell also noted that most sources of price pressures are beginning to subside, suggesting that inflation is unlikely to accelerate in the coming months. Wages are still growing and have outpaced prices over the past year and a half. But Powell noted that wages are not rising fast enough to boost inflation.

A survey released by the Federal Reserve Bank of New York on Tuesday showed that consumers expect prices to rise just 2.9% in the next 12 months, which would be the lowest such measure in nearly four years. Low inflation expectations are important because when consumers expect more moderate price increases, they are less likely to act in ways that raise inflation, such as speeding up their purchases or demanding higher wages to offset higher prices.

Another potential source of relief for Americans’ budgets is apartment rents. They are now barely rising on average nationally, according to real estate brokerage Redfin. Its measure of average rent was just 0.2% higher than a year ago in October, at $1,619, although that figure reflects rents for new leases only.

Story continues below ad

The government’s measure of rents is rising faster because it includes existing rents. Many landlords are still raising monthly payments to reflect the rising costs of new leases over the past three years.

& Edition 2024 The Canadian Press