23andMe is laying off 40% of its workforce, or more than 200 employees, and shutting down its therapeutics division as the struggling genetic testing company tries to cut costs.

The latest restructuring effort was announced by 23andMe on Monday. The company said it plans to wind down ongoing clinical trials “as quickly as possible” — and that it is currently evaluating “strategic alternatives” for assets related to its drug development and research programmes, which include studies on potential cancer treatments.

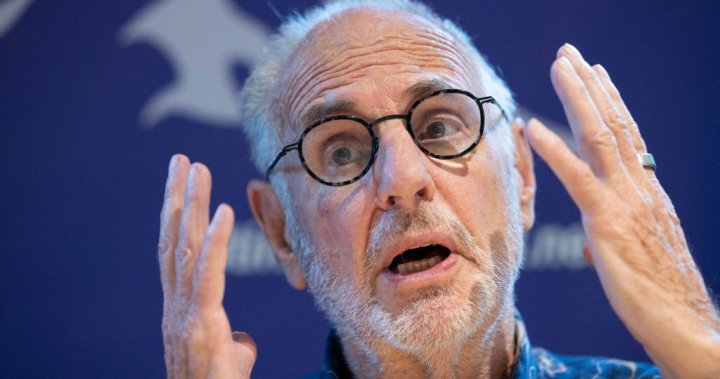

In a prepared statement, Anne Wojcicki, CEO and co-founder of 23andMe, said the company is “taking these difficult but necessary actions” as it focuses on “the long-term success of our core consumer business and research partnerships.”

The restructuring comes during a period of turmoil at California-based 23andMe, which recently included a high-profile data breach, several rounds of previous layoffs and accumulating losses that have sent the company’s shares tumbling in recent years.

Story continues below ad

Last September, all of 23andMe’s independent directors also resigned from its board — a rare move that followed lengthy negotiations with Wojcicki, who had been trying to take the company private. The seven resigned directors said they had not yet received a suitable deal offer from the CEO, and noted there was a “clear” difference of opinion about 23andMe’s future.

DNA testing company 23andMe used customer samples to develop drugs

At the time, Wojcicki said she was “surprised and disappointed” by the resignations, but insisted that taking 23andMe private and “out of the short-term pressures of public markets” would be best for the company in the long term.

Get daily national news

Get the day’s top political, economic and current affairs news, headlines, delivered to your inbox once a day.

More than a month after Wojcicki left as the sole board member, 23andMe announced it had appointed three new independent directors in late October.

Trending now

-

![]()

RCMP report reveals new details about GTA Man and his fake memes

-

![]()

How Canadian Consumers Can Spot Counterfeit $2 Coins

23andMe went public in 2021 and has struggled to find a profitable business model since then — especially with most buyers of saliva-based test kits only needing to make a single purchase. The company reported a net loss of $667 million in the last fiscal year, more than double the loss of $312 million the previous year.

Story continues below ad

23andMe reported another loss in quarterly earnings released Tuesday, though it fell less than in previous quarters. The company reported a net loss of $59.1 million for the second quarter of fiscal year 2025, compared to a loss of $75.3 million for the same previous year.

However, revenue totaled $44.1 million for the second quarter — down from $50 million from the previous year. The company cited lower sales of test kits and telehealth orders, as well as a decline in research revenue, but said that was partially offset by growth in membership services.

23andMe expects the job cuts and other restructuring efforts announced Monday to reduce operating expenses and save the company more than $35 million annually. 23andMe also expects to incur up to $12 million in costs, primarily related to one-time severance pay and other severance-related expenses.

23andMe ended the quarter with cash and cash equivalents of $127 million, compared to $216 million as of March 31, 2024.

Last month, 23andMe completed a 1-for-20 reverse stock split. Shares were down about 4% by midday Tuesday, settling at about $4.43.

& Edition 2024 The Canadian Press