An American TD Bank employee who worked in the bank’s highly scrutinized anti-money laundering department has been criminally indicted in New York, the Manhattan District Attorney announced Thursday.

Daria Sewell is charged with unlawful possession of personally identifiable information that she allegedly stole from TD Bank customers and distributed on Telegram, according to a statement from Alvin Bragg’s office.

The indictment comes shortly after the US arm of TD Bank pleaded guilty to violating a US law aimed at preventing money laundering – the largest bank ever to do so – and was hit with a historic US$3 billion fine.

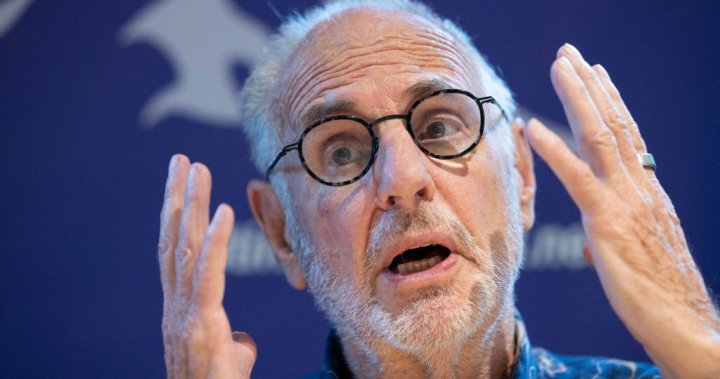

“This defendant allegedly abused her access while working in the anti-money laundering department at TD Bank to rip off the bank’s customers,” Bragg said in a statement.

“Telegram can be a hotbed of criminal activity, and we have detected everything from fraud to illegal firearm sales and terrorist financing.”

Story continues below ad

The charges against Sewell stem from a larger investigation in which five other people were charged in an alleged check fraud scheme totaling approximately $500,000, which allegedly saw the defendant deposit stolen checks into their personal bank accounts, the District Attorney’s Office said.

Business Matters: TD Bank will pay $3 billion in a landmark money laundering settlement with the US Department of Justice

The investigation found that the five other defendants, among others, communicated with Sewell about “strategies for committing” check fraud.

Get weekly money news

Get expert insights and Q&As on markets, housing, inflation and personal finance information delivered to you every Saturday.

According to the indictment, a search warrant executed on Sewell’s phone found that she had images of 255 checks in the names of TD Bank customers, along with personal information for approximately 70 other customers including names, addresses and Social Security numbers.

Sewell allegedly then distributed the information on a Telegram channel she was running, and would direct others to open bank accounts to deposit checks. It then splits the profits with these people, according to the indictment.

Story continues below ad

Sewell, 32, a New York resident who worked for TD from 2023 to May 2024, has yet to respond to the charge and allegations in the indictment.

Bragg’s office said the investigation into the check fraud scheme and Sewell’s alleged conduct remains ongoing.

In its indictment of TD Bank’s US divisions last year, the US government accused TD Bank of ignoring several red flags from high-risk customers and creating a “conducive” environment for money laundering.

TD Bank’s failure in money laundering controls allowed criminals to launder more than $670 million through the bank over six years, including profits from fentanyl trafficking, according to US authorities.

Trending now

-

![]()

A Bank of Canada official warns of the risks of “adjustment” in mortgage rules

-

![]()

Searches for “move to Canada” spiked after the US election, but it’s not that simple

Business Matters: TD Bank suffers a $181 million loss amid accusations in an anti-money laundering investigation

TD Bank’s settlement of the charges included accepting an asset cap on its U.S. business interests, which prevented it from expanding further.

Story continues below ad

US Senator Elizabeth Warren, a Democrat from Massachusetts and a frequent critic of financial institutions, wrote to the US attorney general last week saying the settlement failed to hold corporate executives accountable.

Executives and the bank itself were able to evade the full scope of sanctions that Congress could have imposed, despite allowing the bank “to operate as a criminal enterprise and harm hundreds of thousands of people,” Warren said.

TD said it is making the investments, changes and improvements required to meet its anti-money laundering program obligations in both Canada and the United States.

Canada’s national financial intelligence agency Fintrac imposed a record $9.2 million fine on TD earlier this year over lax money laundering controls.

Prime Minister Justin Trudeau said last month he was “concerned” about the alleged actions at TD, and the federal government says it has introduced a slew of measures to strengthen oversight of money laundering in Canada.

– With files from The Canadian Press

&Copy 2024 Global News, a division of Corus Entertainment Inc.